Serving Expats across

Easy to navigate & straightforward

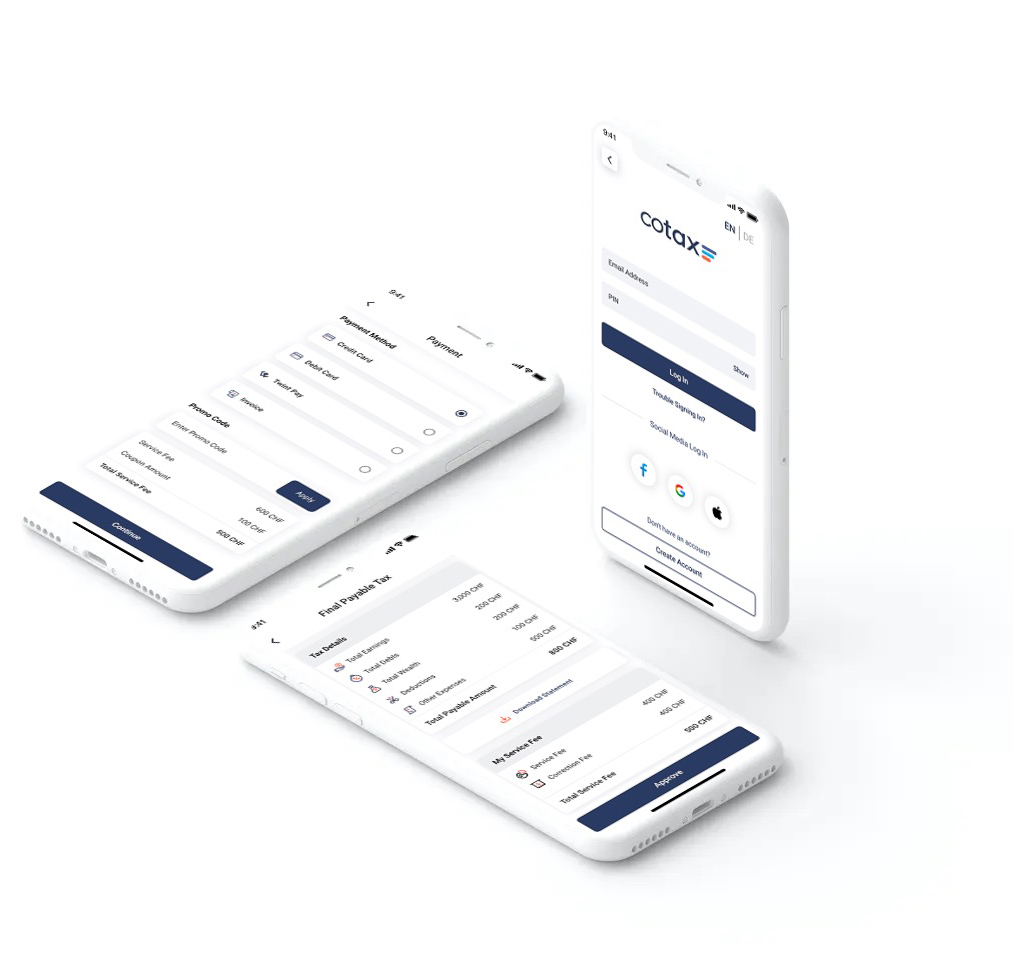

Download our app for free and submit all info whenever you want. We will guide you through all steps in a survey-like form, using simplified questions and with examples of required documents.

Support for various tax situations

The latest generation of A.I. is charged with our Swiss tax specialists human expertise to handle different situations, from regular to more complex cases. With us, there is no such thing as a too complicated case.

Save time by relying on our experts

All you have to do is provide the details and documents, and we will take care of the rest. It takes only 7 minutes to fill it out, we checked. Yes we did check, it could take evne less.

No tax knowledge needed

Forget about tax vocabulary and confusing terms.We promise that it’s far less painful than dealing with the official tax forms.

How It Works

01

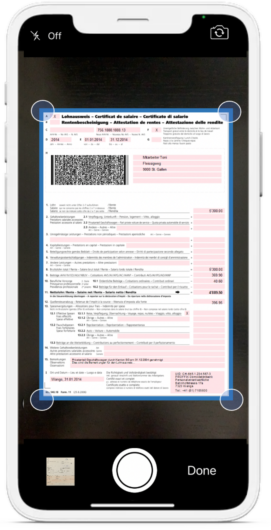

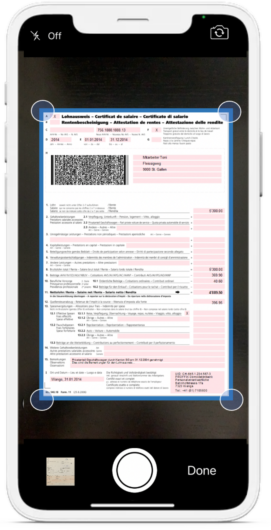

File details and documents

Tell us about yourself and submit required documents by taking quick snaps or uploading them straight to the cotax app. We will guide you through a list of relevant questions using simple language.

02

We optimize for deductions

cotax gathers only documents and the information necessary to uncover opportunities for more deductions and process your case. Your tax return is completed by A.I & the experienced team of tax experts, looking at each detail to ensure you receive the most out of your tax return.

03

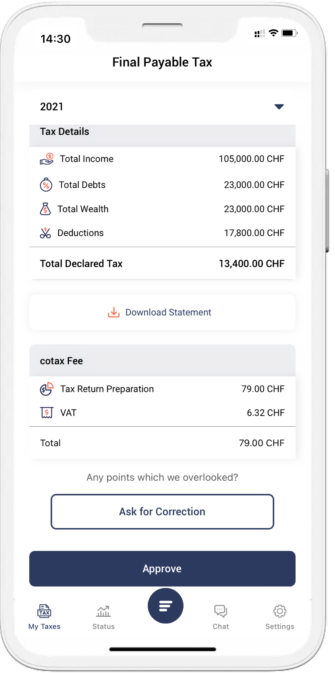

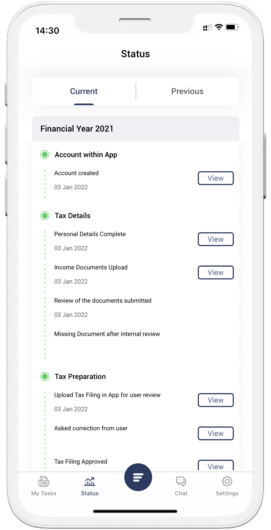

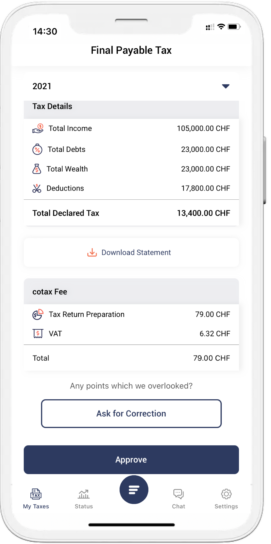

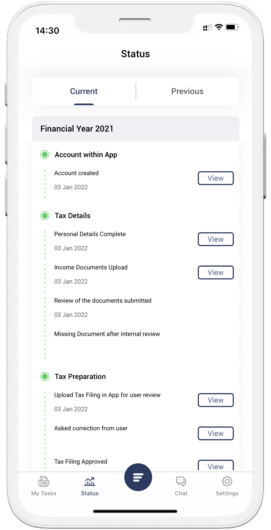

Review and confirm

Get the completed tax return within 48 hours. If in doubt, we will address any concerns you may have. Approve your tax return in a single tap. You will receive the hard copy of your tax return via post. All you need to do is sign and submit to tax authorities.

How It Works

01

File details and documents

Tell us about yourself and submit required documents by taking quick snaps or uploading them straight to the cotax app. We will guide you through a list of relevant questions using simple language.

02

We optimize for deductions

cotax gathers only documents and the information necessary to uncover opportunities for more deductions and process your case. Your tax return is completed by A.I & the experienced team of tax experts, looking at each detail to ensure you receive the most out of your tax return.

03

Review and confirm

Get the completed tax return within 48 hours. If in doubt, we will address any concerns you may have. Approve your tax return in a single tap. You will receive the hard copy of your tax return via post. All you need to do is sign and submit to tax authorities.

Join Many Happy Customers!

Data Protection is Our Priority

Data encryption

That means that all data is encrypted at any given moment, securing that the information you enter is protected.

Privacy is Priority

Our data protection complies with Swiss data protection laws, cotax has implemented all necessary measures for security and privacy. Also we take extra steps to ensure you are protected all the time.

All Data within Switzerland

Our servers are located in secure data center in Switzerland, with latest technology for security and environmentally friendly. Servers are under strict access control all the time.

Extra Protection

We use 2-step verification to help ensure better protection to your account, PIN and OTP over registered phone number, which is similar method banks use for their online service.

What You Get With cotax

Want to learn more about Income Taxes and Deductions in Switzerland?

Below you can download the guide for free:

Three Simple Packages

Transparent Pricing based on your situation, nothing more!

Payment Options:

Disclaimer: Prices are set based on your situation and condition. Additions to Lite and Pro packages: Cash Inheritance CHF 49, Shares CHF 69 and Property CHF 69. Additions to Max Package: Cash Inheritance CHF 49, Stock Options CHF 69 and Property CHF 69. If the information that you provide is not complete nor accurate then there will be additional costs added to your case based on the amount of time needed to complete your tax return. The correction fee will be by hourly rate of CHF 90, you would be notified for the charge and it will be included in the total price. In case there is other additional work then the hourly rate applies.